Reuse models for packaging are being adopted by brands and retailers as a means to decrease waste and alleviate the burden on recycling resources, and also appeal to customers in the growing lifestyles of health and sustainability (LOHAS) market.

Unlike recycling, there is no need to sort and break down materials to turn them into recyclate. With reuse, containers and materials are cleaned, and labels are changed where necessary. Containers are then refilled with products and made available for resale. Likewise, there are also options for consumers to clean containers themselves and either refill them in selected stores or from supplies delivered to their homes, with some brands offering refill packs as part of a subscription service.

The carbon savings enabled by reuse can be significant. For example, an estimated 503g of carbon dioxide is produced from making one 500ml glass bottle from virgin materials. While this impact is reduced by recycling glass, there are greater carbon savings available by keeping existing glass bottles in circulation for longer.

Reuse is already established and incorporated into operations at scale within business-to-business (B2B) applications, but the focus is now on business-to-consumer (B2C) applications to help tackle the growing problem of consumer waste.

And there is a clear appetite amongst consumers for packaging that is recyclable or results in zero waste. In GlobalData’s Thematic Intelligence report, Circular Economy in Foodservice in 2022, a survey revealed that the top three factors considered most important for packaging by consumers were easy to recycle, zero-wastage, and easy to dispose of.

Reusable packaging still scored highly with 65%, but consumers considered it a lower priority than compostable and biodegradable packaging – which typically have far lower use cycles. Yet there are considerable benefits to reuse that should not be overlooked.

The reuse model in action

The concept of reuse is hardly new, with schemes for glass bottles containing milk and soft drinks running for decades. A host of new reuse schemes are now in place around the world, covering everything from beer, cups of coffee and fresh meals to cleaning products and cosmetics. Some businesses also run deposit return schemes (DRS) with small payments issued to consumers for returning used packaging. While other businesses offer incentives such as discounts on future purchases for customers reusing containers.

“There are existing reuse models that work – like the beer bottles here in Germany,” explains Ingo Fehr, senior project manager of advanced recycling and deinking at Siegwerk – specialists in sustainable inks and coatings, and leaders in the circular economy. “The beauty of this model is you're just collecting all your glass beer bottles in one place at home, and it doesn’t matter so much for the brands or bottle sizes.

“When this pile becomes too big, you go to the beer shop and take that back. And people do it – everyone has this ‘Pfandkiste’ somewhere in their homes. If you want to have a similar effect in other packaging types, you need that ease of utilisation. So, one shop accepts almost everything.”

For any reuse scheme to succeed, it is also vital to have convenience built into the operations model for consumers and businesses alike.

“It's really: How will the end-users fit in there?” comments Fehr. “It's either how you convince the end-user to sacrifice all this comfort and take this inconvenience; or how you imagine a reuse system where this inconvenience is not there. And that's a big challenge.”

One way to build convenience into reuse models is through at-home collections running alongside existing waste collection services. Another reuse model includes a DRS that relies on installing collection points at supermarkets where consumers can drop off their used packaging when they are there for shopping.

The uptick in deposit return schemes

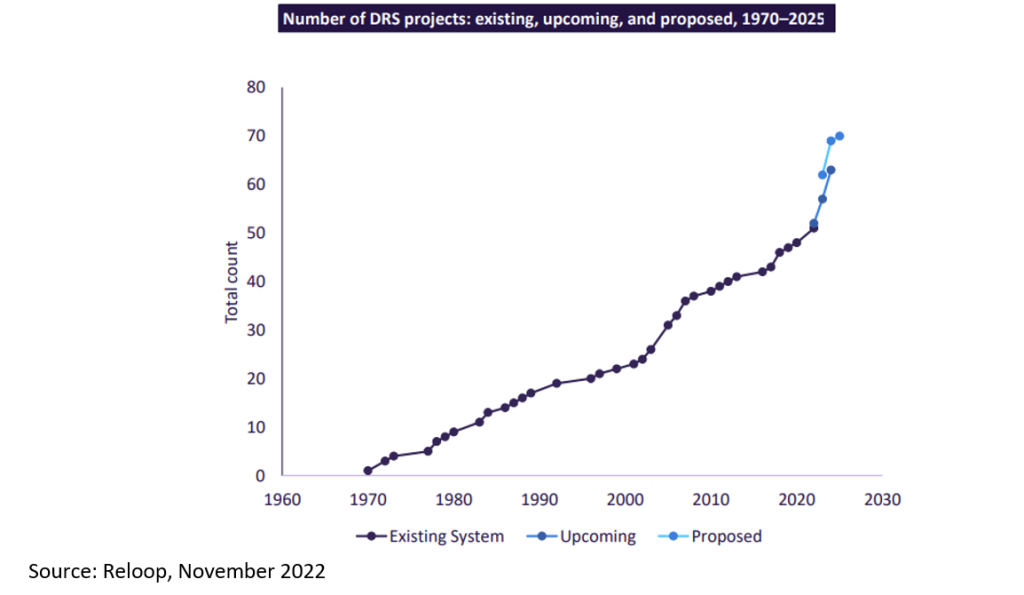

The number of deposit return schemes in use around the world has steadily increased since 1970.

However, the last three years have seen a significant upsurge in deposit return schemes in the pipeline as countries do their best to grapple with the issue of consumer waste.

Incentivising consumers to return used packaging has proven highly effective in increasing recovery rates of materials. Countries with DRS models running have reported consistently high recovery rates of glass bottles. And according to GlobalData analysis, some nations have seen 97% recovery rates for PET plastic bottles.

For DRS trials that have been running recently at supermarkets in several countries, the advantages are the convenience for the consumer and that there is often already the infrastructure to collect, store and send on materials for processing. With the advent of digital payment technology, establishing a deposit return system is relatively straightforward.

However, it is not yet clear if and how similar reuse schemes will cope with such levels of complexity and the growing volumes of waste in an economically sustainable way. Therefore, further research is required to determine the viability of similar models and the potential for scale-up.

How inks and coatings can help the reuse model

For reuse to be feasible on the necessary scale, it will require standardisation. Brands and competitors may have to use the same model of containers, meaning that products may look similar on the shelves in terms of shape. And a balance is required between standardisation and individualisation for brands. This is where inks and coatings come in, offering brands important opportunities for customisation.

“From an inks and coatings perspective, we really wanted to investigate the ‘sweet spot’ between being able to provide variable print information on a standardised packaging form,” says Sarah Mah, global sustainability manager at Siegwerk. “This enables standardisation within transport, as well as within cleaning, which is essential for success in a reuse model.”

There are further opportunities for brands to stand out from one another such as using their own branded labels. However, these labels will still require removal before containers can be reused. One potential solution that also lessens the volume of materials in circulation is by printing directly onto packaging, decreasing the need for paper for labels and inserts, as well as adhesives.

Deinking via hot washing allows the removal of inks and coatings to make the packaging clean, unbranded, and reusable. Digital printing and deinking are specialist areas for Siegwerk, which also provides a range of sustainable inks and coatings for packaging applications.

"Part of the digital strategy is digital print, which can enable printing directly onto 3D forms. We also have expertise in deinking. So, we have expertise in both of these areas,” adds Mah. "Siegwerk can provide a really unique value proposition to the reusable inking space."

The key factors in establishing the reuse model

Ultimately, the success of reuse models and the wider circular economy will require a reconstructed supply chain and systems overhaul. To succeed, it is vital to have engagement and a desire for change from consumers and businesses.

What works in the favour of the reuse model in future is that younger generations of consumers are more likely to base purchasing decisions around the impact of packaging on the environment. In a GlobalData consumer survey in 2021, 44% of Generation Z and Millennials said they were often or always influenced by how their product packaging would impact marine life.

The GlobalData report, titled Top Trends in Packaging 2022, also highlighted the need for brands to better communicate the benefits of reusability and circular packaging to older consumers that may be more reluctant to embrace changes in habits.

Another key factor required for a successful reuse model is scalability. Economies of scale are crucial for the reuse model to function as intended, along with the multiple-use cycles to make reuse viable both environmentally and economically.

And finally, legislation is going to be fundamental in establishing the reuse model on the scale required. Extended Producer Responsibility (EPR) schemes are already in place in certain regions around the world such as the European Union. EPR effectively places greater responsibility on companies for the lifecycle of the products that they produce, with additional fees used to fund waste management for certain types of materials – notably plastics. As a consequence of EPR fees, there is a possibility that reuse will become more common to keep materials in circulation for longer.

“We are already seeing legislation around reusable packaging for the food space. And we're also seeing the introduction of eco-modulation within the Extended Producer Responsibility fee structure, which will hopefully have some sort of benefit to reuse models,” explains Mah. “We'll see the needle moving because you're impacting the bottom line if you have fees imposed on the supply chain dictated by the government.”

To learn more about Siegwerk’s work in the circular economy and the potential cost savings available, download the paper below.