GlobalData, a leading data and analytics company, has revealed its global league tables for top 10 financial advisers in consumer sector by value and volume for 2021 in its report, ‘Global and Consumer M&A Report Financial Adviser League Tables 2021’.

According to GlobalData’s M&A report, a total of 4,064 mergers and acquisitions (M&A) deals were announced in the sector during 2021, while deal value for the sector increased by 38.8% from $270.8bn during 2020 to $376bn during 2021.

Top advisers by value and volume

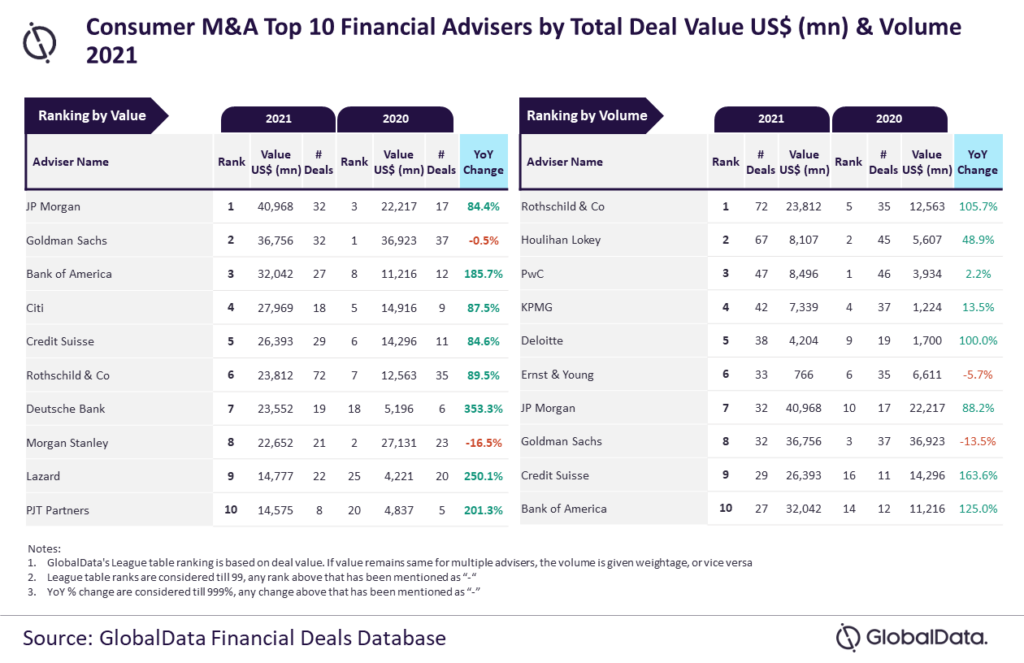

JP Morgan and Rothschild & Co were the top M&A financial advisers in the consumer sector for 2021 by value and volume, respectively.

JP Morgan advised on 32 deals worth $41bn, while Rothschild & Co advised on 72 deals worth $23.8bn.

GlobalData lead analyst Aurojyoti Bose said: “Both JP Morgan and Rothschild & Co were clear winners in terms value and volume, respectively. While JP Morgan was the only adviser to cross the $40 billion mark, Rothschild & Co was also the only firm that advised on more than 70 deals during 2021.

“Interestingly, Rothschild & Co also managed to secure sixth position by value, while JP Morgan occupied seventh position by volume.”

Goldman Sachs occupied the second position in terms of value, with 32 deals worth $36.8bn; followed by Bank of America, with 27 deals worth $32bn; Citi, with 18 deals worth $28bn; and Credit Suisse, with 29 deals worth $26.4bn.

Houlihan Lokey occupied the second position in terms of volume, with 67 deals worth $8.1bn; followed by PwC, with 47 deals worth $8.5bn; KPMG, with 42 deals worth $7.3bn; and Deloitte, with 38 deals worth $4.2bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.